Electric vehicle multi-use: Optimizing multiple value streams using mobile storage systems in a vehicle-to-grid context

Author: Waqas Javaid

A B S T R A C T

Driven by the need for a sustainable energy transition and a paradigm shift in the energy and mobility sectors, the popularity of electric vehicles is on the rise. Learning curve effects and falling investment costs further accelerate the deployment of electric vehicles with lithium-ion batteries; and as a multi-purpose technology, they are predestined for serving multiple applications. In this work we present an electric vehicle multi-use approach for a German commercial electricity consumer with an electric vehicle fleet. We analyze which behind-the-meter and in front-of-the-meter applications are particularly suitable for electric vehicles from a techno-economic point of view. In addition to providing the mobility service, we investigate the applications self-consumption increase, peak shaving, frequency regulation, and spot market trading. For the implementation of the approach, we introduce a model predictive control framework in which a mixed-integer linear programming algorithm is combined with a semi-empirical degradation model. The approach is analyzed with the investigation of fleet sizes from 1 to 150 vehicles, different application combinations, possible energy shift between the energy partitions, bidirectional charging schemes, and degradation awareness formulations. The results show that the deployment flexibility and application synergies increase with the number of stacked services, leading to additional annual cash flows of up to 2224 EUR per electric vehicle as well as battery lifetime improvements.

Keywords: Multi-use Electric vehicle, Vehicle-to-grid, Battery Peak shaving, Frequency regulation, Spot-market trading

1. Introduction

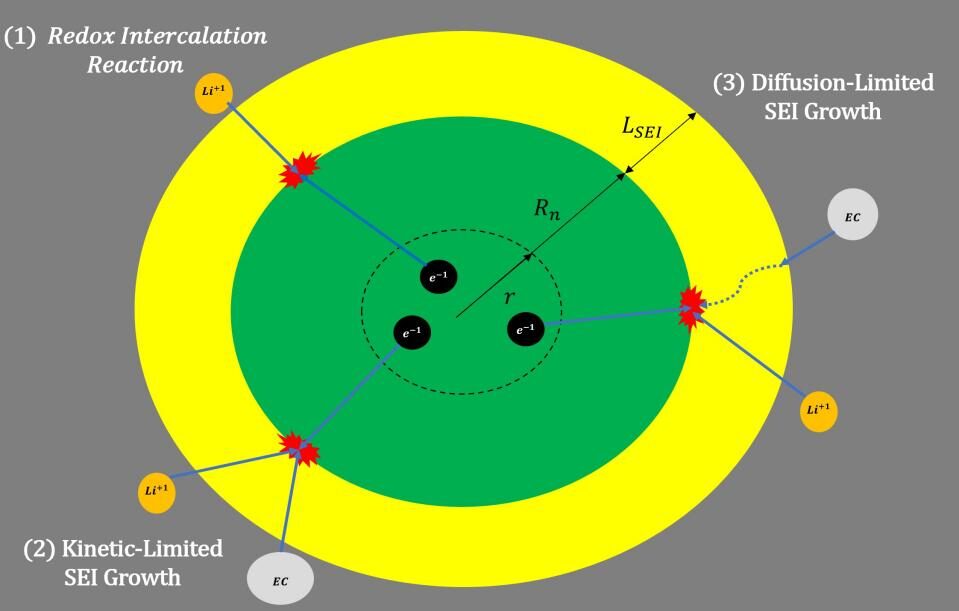

Rising global awareness of the urgent need for a sustainable energy transition places increasing pressure on the energy sector to prioritize resource efficiency and ambitious sustainability targets [1]. This is accompanied by an increase in renewable energy [2] and a greater need for energy storage to balance the largely volatile renewable power generation [3]. Due to learning curve effects [4], battery cell prices have fallen significantly in recent years [5], with lithium-ion batteries enjoying especially strong growth [6]. One of their unique benefits is that battery storage systems can be used in a variety of applications, such as grid services with stationary battery storage or mobility provision in electric vehicles (EVs). In the stationary sector, it is now apparent that combining several applications on a single storage, or so-called multi-use [7], is economically viable [8], yet still hindered by regulation [9]. Continuous research and development in the field of battery EVs is expected to further increase the capacities of lithium-ion batteries used. Correspondingly, the annual demand for automotive battery capacity is projected to increase from 300 GWh in 2020 to between 1.6 and 3.2 TWh per year by 2030 [10]. These installed battery capacities offer enormous potential to substitute stationary storage systems since EVs are primarily purchased for mobility purposes but spend up to 96% of their lifetime parked and unused [11]. Through aggregator concepts [12], EVs can support the electricity grid during idle times by balancing power or storing renewable energy [13]. This is realized by using either smart unidirectional charging or vehicle- to-grid (V2G) technology. In the latter case, the vehicle’s energy can be discharged into the grid and thus offers an enhanced flexibility potential compared to unidirectional charging [14]. Pools of EVs can participate in a variety of markets, such as ancillary service markets, during idle times [15].

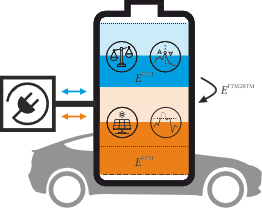

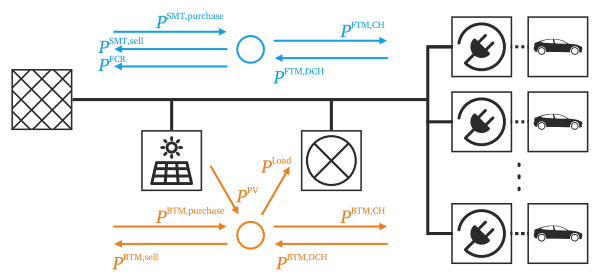

With its fast response times [16], the lithium-ion storage technology is capable of providing a wide range of applications [17], making it a multi-purpose technology [18]. Due to global demand pull policies [19], increased deployment [20], and economies of scale [21], the investment attractiveness is continuously increasing [4]. Although battery energy storage systems have many advantages in comparison to other storage technologies, the technology can struggle with profitability issues when applied to single-use cases [22]. When serving one application only, storage systems often show low utilization [23] and a high share in idle times [24]. As lithium-ion batteries suffer from internal degradation processes [25], which also occur during idle times [26], the fact of a limited lifetime must be considered when defining the optimal deployment strategy [7]. Literature has shown that for stationary storage systems, serving multiple applications simultaneously can maximize the utilization [27] and therefore minimize the share of idle times [28]. Three multi-use types are identified – sequential, parallel, and dynamic multi-use – that differ in the temporal and physical allocation of the technical capacities of the storage system [27]. With its capability of providing consumer centered applications, but also grid and ancillary services [8], batteries yield economic value at different origins of the electricity value chain [9]. To comply with existing un- bundling laws, a separation of value generation in the electricity value chain becomes necessary when serving multiple applications [7]. Thus, we distinguish between behind-the-meter (BTM) and in front-of-the- meter (FTM) applications [27]. Technically, this separation between BTM and FTM applications is achieved by dividing the physical storage into two virtual partitions and thus allocating the technical capacities – power and energy – of the system. With this stacking of applications on an energy storage system the economic value is maximized [29].

V2G describes a smart grid concept [15], where EVs are connected to the grid with the goal to provide value that goes beyond mobility provision [30]. This enables a more efficient management of electricity resources and better renewable energy integration [15], as well as the potential to mitigate future grid infrastructure investment costs [31]. EVs are an attractive option for these services as they are characterized by quick response times [11] and a high degree of geographic and temporal flexibility [32]. One approach for an intelligent integration of EVs is smart charging, which describes an unidirectional charging scheme that reduces charging costs and peak load by strategically timing the charging power [33]. This approach is comparatively easy to implement as it only requires a suitable charging controller instead of specialized hardware [34]. However, bidirectional charging also enables energy to be fed back into the grid, thus allowing the full spectrum and revenue of services available to conventional stationary storage systems [35]. This requires more complex, specialized bidirectional chargers [36] and can lead to increased battery aging [37], which poses a challenge for gaining user acceptance. Therefore, currently only few car manufacturers provide vehicles capable of bidirectional charging [30]. Furthermore, where traditional energy grids rely on centralized and deterministic grid architectures, V2G preferably utilizes a decentralized approach, in which an aggregator acts as a third party between multiple EVs and the grid operator [38]. This allows the aggregator to be treated similarly to a conventional ancillary service provider and allows an easier integration with reduced communication infrastructure requirements [39]. Aggregators are often necessary to meet the minimum power requirements and regulatory prerequisites that must be fulfilled to participate in existing markets [40]. Due to these reasons, V2G is especially interesting to commercial fleet operators [30], such as company fleets [41]. The economic viability of V2G has been examined in multiple studies with highly varying profitability results [42]. This is due to V2G viability being dependent on various factors regarding technology, market structure, policy, and business models [43]. Future changes that should be implemented to support the V2G concept include the avoidance of double taxation for energy charged and discharged, increasing the emphasis on smart grid solutions and implementing policies that favor small providers, such as lowering required bidding increments [43]. Furthermore, uniform technology standards for charging and communication infrastructure should be implemented [44].

Analogous to stationary storages, where multi-use is key to achieving profitability [19,45], the stacking of multiple applications is also an opportunity for EV owners and other involved parties to achieve greater profitability potential [13]. Whilst research has demonstrated that V2G can generate revenues for EV owners using single applications such as frequency regulation [46] or peak shaving [12], to the best of our knowledge, a viable EV multiuse approach has not yet been presented. The decisive factor here, is the analysis of which applications are appropriate for EV multiuse and how the approach can be successfully implemented using EVs [47].

This paper presents a methodology for EV multi-use, which considers technical, economic, and regulatory perspectives and constraints. To fulfill regulatory requirements of unbundling laws [9], the storage resources are separated into BTM and FTM applications. We focus on evaluating the following effects:

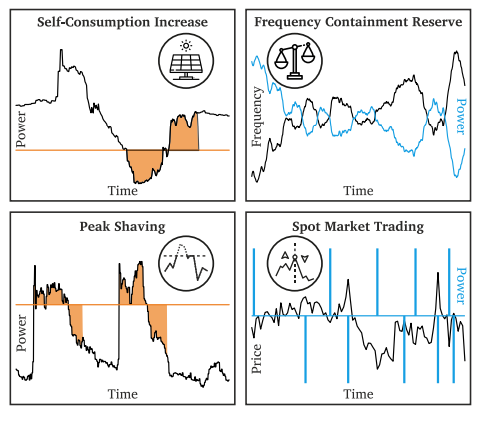

- Stacking of up to four additional applications on the EV battery, on top of the vehicle’s mobility provision: self-consumption in- crease (SCI), peak shaving (PS), frequency containment reserve (FCR), and spot market trading (SMT)

- Unidirectionalcharging versus bidirectional V2G operation

- Energy shift from in front-of-the-meter (FTM) to behind-the-meter (BTM) partition permitted or not permitted

- Batterydegradation due to higher storage utilization

Our results demonstrate that EV multi-use – or the utilization of EV batteries for multiple applications in addition to mobility provision – is a viable technology that can boost profitability for EV owners and other stakeholders through a variety of application combinations. Utilizing a mixed-integer linear programming (MILP) model, the presented EV multi-use approach makes a valuable contribution to bridge existing literature gaps, by:

- Evaluating the combination of multiple value streams on a com- mercial EV fleet

- Distinguishing between behind-the-meter (BTM) and in front-of-the-meter (FTM) applications for EV fleets

- Allocating both the EV battery’s power and energy capacities to each of its applications

The paper is structured as follows. In Section 2, we describe the value streams for EVs and review related literature. Section 3 explains the methodology of the analysis, the optimization algorithm, and the model predictive control (MPC) framework. The results of our analysis are presented in Section 4 and the conclusions are drawn in Section 5.

2. Value streams for electric vehicles

This section describes the five value streams that we investigate in this work. Besides the state of the art literature for the respective applications and use-cases, the mathematical formulation is described in the following subsections.

2.1. Mobility provision

Although vehicles spend approximately 96% of their lifetimes parked, providing mobility is their primary purpose [48]. The main categories of EV use types are domestic and commercial vehicles [30]. While the former do not usually follow any fixed schedules, commercial vehicles not only follow predictable patterns, but are also usually parked in the same area and characterized by fewer actors and more experience [30], making them particularly attractive for V2G concepts [41]. Further distinctions must be made in regard to vehicle usage patterns. Two main types of domestic driver categories are commuters and supplementary users; supplementary users are characterized by long plug-in times at home and occasional trips, while commuters show very predictable trips to their workplace on weekdays [35]. Using EVs in vehicle-to-building settings reveals economically interesting synergies between charging times, photovoltaic (PV) generation and building energy consumption [49].

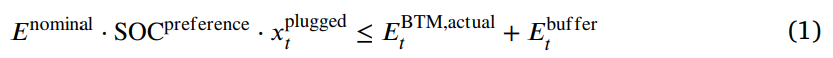

V2G participation depends heavily on successfully mitigating social hurdles, such as range anxiety, which is why it is important to implement rules concerning a preference state of charge (SOC) [50]. This is implemented in our optimization framework in the form of soft constraints that apply opportunity costs to energy levels that are below the preference SOC threshold (cf. Eq. (1)). Here, the actual energy content of the BTM partition and the buffer energy must be equal to or greater than the energy content at the preference SOC level. This is set to 20% [51], corresponding to approximately 64 km range when regarding a battery with a capacity of 80 kWh and a conservative average energy consumption of 0.25 kWh/km [52]. With the consideration of the binary variable 𝑥plugged, the opportunity costs for the buffer energy only apply when the vehicle is connected to a charging port, which leaves the driving state of the vehicle unaffected by the constraint. For the mobility provision the BTM energy is regarded, as the FTM energy is spared certain surcharges and may not be used for driving.

2.2. Self-consumption increase

An increasing number of countries have implemented feed-in-tariffs and demand pull policies to incentivize an increase in renewable energy technologies [19]. The gap that arises between the relatively low price granted by subsidies (pBTM,E,sell) and the retail purchase price appropriate power threshold, above which PS is applied (cf. Fig. 1). An exceedingly low threshold results in a large energy demand for the PS application and excessively drains the battery, whereas a too high threshold leaves PS potential untapped. For this reason, the PS threshold, 𝑃̂ BTM, is included as a decision variable in our optimization framework.

(pBTM,E,purchase), provides prosumers with an incentive to increase self- consumption [53]. As solar panel prices decrease and private and commercial buildings are thus increasingly equipped with micro generation [45], storage systems become a promising tool to perform SCI and thus reduce electricity costs [35] and carbon emissions [54].

This is especially economically interesting in countries with high retail electricity prices [45]. A further benefit of SCI is a reduction in stress on the electricity distribution grid [54], especially through peak PV generation, which mitigates future infrastructure investment costs and ensures a more efficient grid operation [55]. When applied to V2G concepts, the viability of SCI becomes especially dependent on mobility behavior [54], as the vehicle plug-in times should match times of PV generation [56]. This can be difficult with typical commuter driving profiles [35]. In home applications with non- commuters, V2G based SCI can render conventional stationary storage systems obsolete [35].

In our paper, workplace SCI with an aggregated fleet of EVs is considered. To quantify the profit from this application, the total optimized electricity cost is calculated as the difference between the purchase costs and revenues from selling energy, as in Eq. (2). As SCI is a ing when connected to the grid [40]. Ancillary service markets are relatively mature and already established in several countries [22]. With these services the grid frequency in the European network of transmission system operators for electricity (ENTSO-E) is kept within a ±10 mHz deadband zone around the nominal frequency of 50 Hz [63].

2.3. Peak shaving

Contrary to residential electricity consumers, commercial players often consume significant levels of electricity from the grid [57]. For this reason, such consumers are not only charged for the consumed energy, but also for their peak power demand [57], which constitutes significant costs [58]. In the case of Germany, power demand is averaged over 15 minute intervals and the peak power over the entire billing period is utilized to determine the power charges, which consumers with an annual consumption above 100 MWh are required to pay [7]. Besides high consumer costs, large power spikes also constitute more stress on the grid [49], which will require an increase in power generation or an upgrade of the grid infrastructure [59]. To avoid these problems, PS is utilized, which describes strategies to reduce the peak power demand. In the past, this has been practiced among other by deploying diesel generators [57]. For the future however, demand side management strategies and energy storage systems [60], especially batteries, have been proposed [58]. With the addition of EVs and potential uncontrolled charging simultaneity, the problem of peak loads is further exacerbated [49]. Therefore, to mitigate these problems, optimized V2G strategies can perform PS [49]. While this application is argued to be of high value for V2G, it can be very energy intensive, which can risk excessively discharging the EV battery [11]. Since PS is an application that is only required during demand peaks [60], it naturally lends itself to multi-use approaches [7]. With enough participating vehicles, V2G can completely replace other methods of performing PS [61]. To effectively perform PS, precise predictions of power peaks are vital, Since the battery must provide the energy and power required to fully cap the peak [57].

The basis for the PS optimization is the calculation of peak power costs as the product of the highest power peak and the power price in Eq. (4). This power peak is embedded in a constraint, where it serves as the upper bound of the difference between purchased and sold BTM power, as shown in Eq. (5). As for the other BTM application, SCI, the profit from PS is derived from the cost difference between the optimized and the reference case (cf. Eq. (6)).

2.4. Frequency containment reserve

Another promising V2G application is the provision of regulation power to stabilize the grid frequency [62], as this requires high rates of power within short time periods, which EVs are capable of proving when connecting to the grid.

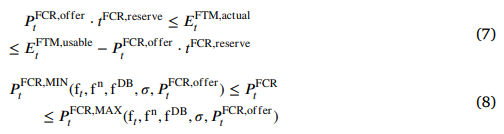

To do so, the electricity balancing products are divided into frequency containment reserve (FCR), frequency restoration reserve and replacement reserve [64]. Of these products, primary control reserve under the FCR category is the most economically interesting in central Eu- rope [27]. As the penetration of renewable energy sources increases and traditional synchronous generators become fewer in number, the need for FCR through storage systems is expected to grow significantly [65]. However, a challenge may arise in the future due to market saturation [12], which leads to sinking FCR remuneration [27] and a decline in revenue earning potential [22]. FCR must be provided over 4 h time blocks and the participating storage system must be designed to provide the allocated power for at least 15 min (𝑡FCR,reserve) [63]. Eq. (7) constrains the energy committed to the FCR application to never exceed the allocated actual energy for the FTM partition, while also limiting the latter, so that the same amount of committed energy can also still be charged into the usable FTM partition. Thus, both positive and negative FCR energy can be provided, as FCR is a symmetric product.

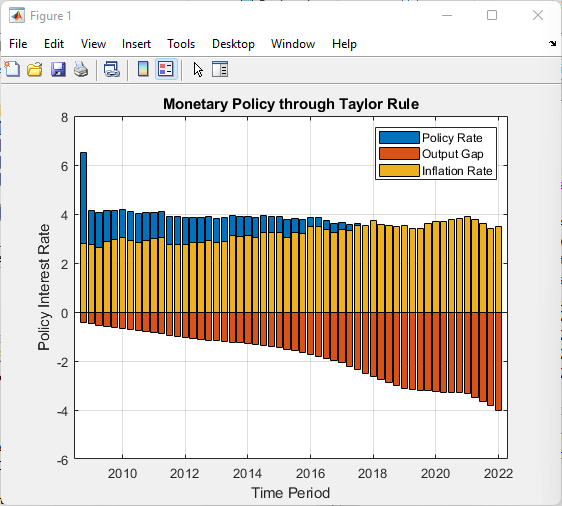

Arbitrage trading utilizes electricity price differentials to achieve profit or mitigate charging costs [22], as shown in Fig. 1. In the past, SMT has not been attractive, especially in single-use scenarios, due to low market price spreads not justifying the increased degradation [22]. Recent developments, including decreasing FCR remunerations and growing spot market price spreads [27], render SMT a promising candi- date for storage application, in part due to an increasing participation of renewable energy [67]. It could be especially interesting in multi- use concepts, for example together with FCR, where SMT is used to balance the SOC and compensate for efficiency losses [68]. While uncontrolled EV charging leads to increased electricity prices, V2G is predicted to have a smoothing effect on spot market prices [69]. This is especially attractive for the further implementation of renewable energy sources, as V2G can help alleviate price drops from surplus feed-in times [69]. The relevant markets in Germany are the day-ahead auction, the intraday auction, and the intraday continuous market [7]. Due to its volatile price signals, the intraday continuous market is well- suited to the high responsiveness of lithium-ion batteries [27], which is why we chose it for further analysis.

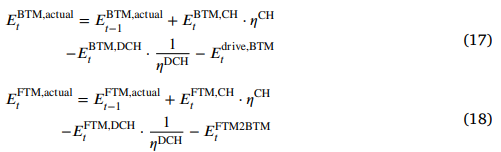

Eq. (10) establishes that within one time step, 𝑡, electricity can either be purchased, sold, or not traded. Here, 𝑥SMT,purchase and 𝑥SMT,sell are binary variables representing whether electricity is sold or purchased.

![]()

The profit of the SMT application is defined in Eq. (11) as the difference between the revenue from sold and the cost of purchased electricity.

2.5 Further value streams

Beside the applications analyzed in this paper, several alternative value streams for EVs have been identified in literature and projects. For instance, with suitable charging hardware, V2G can be used to provide reactive power to help stabilize the grid voltage [15]. V2G is also an option to reduce grid congestion and thus mitigate ex- pensive redispatch measures [31]. Furthermore, EVs can act as an emergency power supply when deployed in vehicle-to-building concepts [70]. When multiple EVs are connected, they can be used for peer-to-peer energy trading [71] or to supplement decentralized electricity grids by providing black start capability and other grid ancillary services [72]. Additionally, EVs can be utilized as mobile power supply units to provide electricity for different purposes, such as machinery and tools [47].

3. Methods

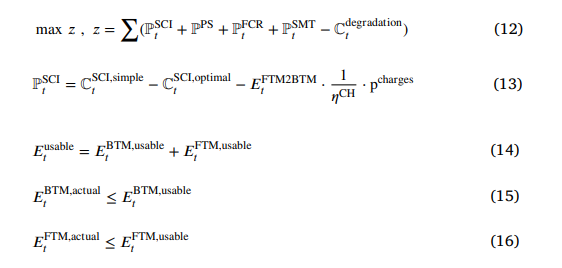

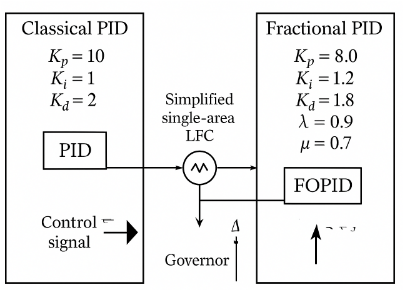

We develop a MILP framework to evaluate the techno-economic effect of EV multi-use. Combined with a MPC algorithm, the MILP optimization is conducted at regular intervals. This approach allows for the optimal scheduling and allocation of power and energy of the EV fleet, as well as a detailed calculation of the battery properties, such as the battery state of health (SOH) [7].

For the study, a German commercial building with a company EV fleet of privately used vehicles and respective charging stations at work is assumed. In this use case, the vehicles’ idle time whilst parked at the office location is utilized to generate value by serving additional applications. The BTM electricity is traded with an energy retailer, using 0.2 EUR/kWh and 0.03 EUR/kWh for the purchase and remuneration price [73,74]. In addition to BTM, the company’s EVs can also use FTM electricity to serve the FCR and SMT applications. A generation profile from a PV generator with 120 kW peak power [35] and a commercial load profile with an annual consumption of 500 MWh is applied [75]. The energy consumption for mobility purposes and the corresponding EV plug-in times at the commercial building are derived using the tool emobpy [76]. emobpy is an open-access tool for creating battery electric vehicle time series based on empirical data. For the purposes of the model developed in this paper, a few definitions and distinctions must be made. The EVs’ batteries are partitioned into clearly distinguishable virtual FTM and BTM partitions [7], to comply with existing unbundling laws and separately allocate system power and energy [8]. BTM applications are generally consumer-oriented and serve to maximize the economic result of the storage system stake- holder. These applications are charged fully with all applicable grid charges, surcharges, and taxes and in this paper include SCI and PS. FTM applications on the other hand serve to stabilize the electricity system and usually only have limited charges applied to them, as the energy is not directly used for consumption purposes. In this paper, these applications are FCR and SMT.

On the EV level the nominal energy describes the rated energy content of the battery, while the usable energy content is limited by battery degradation and SOC boundaries. The actual energy content describes the stored energy at the current SOC. The separation into FTM and BTM partition is shown in Eq. (14), while Eqs. (15) and (16) determine that the actual energy content cannot exceed the usable energy content of the respective partition. 150 annual profiles, with the driving pattern and plug-in patterns at work, were chosen to form the basis of this analysis. For each EV, the annual driving distance is normally distributed around 15 000 km [77] with a usable battery capacity of 80 kWh and a conservative average consumption of 250 Wh/km [52]. For the FCR and SMT applications, price profiles from 2020 [74] and frequency profiles from 2019 are applied [78]. The intraday continuous market data is characterized by multiple price signals, such as low, index, and high price. Literature has shown that the economic potential of the SMT application is very limited when using the index price [7]. On the other hand, the use of high and low price signals is difficult, as a very accurate price prediction is necessary. For these reasons, the average price signal of the low and index price is used for the lower bound of the price corridor. Analogously, the average of index and high price is applied for the upper bound.

3.1. Mixed-integer linear model

The objective function, Eq. (12), maximizes the techno-economic potential of the energy system. All the presented variables in Eq. (12) represent decision variables of the optimization problem, excluding the charging efficiency 𝜂CH and pcharges. For the optimization horizon the optimal operation strategy is calculated, which optimizes the charging power and the allocation of the EV fleet’s capacities simultaneously.

For each time step 𝑡, the entire usable energy is allocated to either of the two partitions (𝐸BTM,usable and 𝐸FTM,usable), so that the partitioning of the storage system is a result of the optimization process and depends on the constraints regarding each application. As part of the usable energy partition the actual energy content (𝐸BTM,actual and 𝐸FTM,actual) describes the energy that is stored in the respective usable partition. In this study, we defined the start value of the actual energy content with 70% SOC.

Eqs. (17) and (18) track the actual energy content of the two partitions and guarantee energy conservation within the battery. For both partitions, the energy content at time 𝑡 is based on the previous energy content at time 𝑡 − 1 and the charged and discharged energy. To consider the energy losses during charging and discharging, and 𝜂DCH are defined with 89.4% efficiency [80]. At the BTM partition the variable 𝐸drive,BTM defines the energy that is discharged from the battery partition and utilized for mobility purposes.

You can download the Project files here: Download files now. (You must be logged in).

When the use of FTM energy for mobility services is permitted by the model, it to BTM partition, 𝐸FTM2BTM, is considered in the objective function. Since the levies and surcharges for FTM electricity are lower compared to those of BTM, this economic difference must be considered when the shift from FTM to BTM energy is permitted. As the energy losses for charging FTM energy into the EV battery are also purchased with reduced levies and surcharges, this cost correction is likewise applied to the charging losses. To prevent arbitrage in the model, these additional costs for energy shifting are subtracted from the SCI application profit. When the use of FTM energy for mobility services is permitted by the model, it is still guaranteed that no energy is directly shifted from the FTM to BTM partition, as this would violate unbundling laws. Instead, the stored FTM energy can be taken from the FTM partition and directly utilized to propel the vehicle (BTM application), as shown in Eq (19).

![]()

Besides the partitioning of energy, a distinction between FTM and BTM power is also applied, which is reflected in Eqs. (20) and (21). For the upper bound of the charging and discharging power, 𝑃 CH and 𝑃 DCH, 22 kW is assumed. The charging behavior is hereby implemented

generator, load, chargers, and electric vehicles (EVs). The arrows in orange and blue highlight the node constraints at the behind-the-meter (BTM) and in front-of-the-meter (FTM) partitions.

as a square profile, in which the optimized charging power under said constraints is applied constantly for the respective time step.

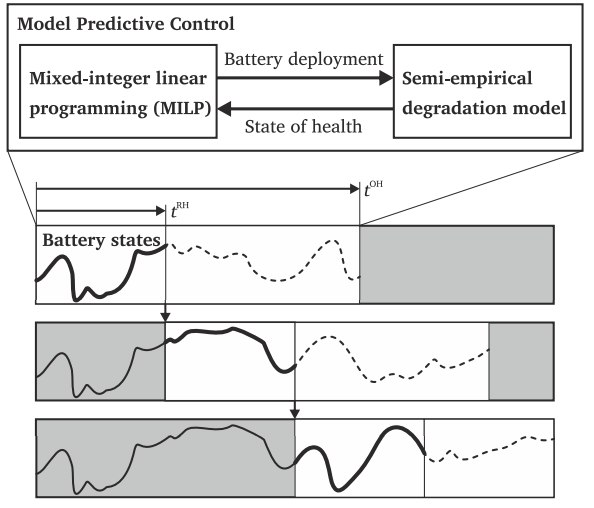

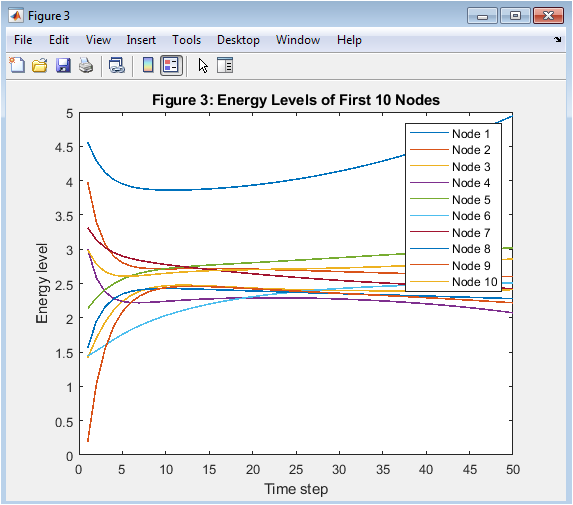

3.2. Model predictive control

An important aspect for the operation strategy of storage systems is the prediction quality of the respective input data, such as power demand, PV generation and driving behavior. In this model, perfect forecast is assumed within the defined optimization horizon 𝑡 OH, of 24 h. With every rolling horizon, 𝑡 RH, of 8 h, the input data is updated, and a new optimization is conducted (cf. Fig. 3). Given this MPC framework, the algorithm allows the handling of prediction values. Due to the overlap of optimization and rolling horizon, the framework is less prone to prediction errors, as the operation strategy is regularly re-optimized. To enable a comprehensive techno-economic analysis, the MPC framework combines the MILP optimization algorithm with a semi empirical aging model. Therefore, the MILP considers opportunity costs

from degradation in the objective function (cf. Eq. (12)). Thus, the model is made degradation aware, which leads to a reduction in battery aging through potentially excessive serving of grid applications [7]. For the calculation of the cycle opportunity costs an expected equivalent full cycle capacity of 1000 cycles until the battery’s end-of-life [81] and battery investment costs of 200 EUR/kWh are assumed [5]. The modeled EV batteries are assumed to consist of cells with a lithium–nickel–cobalt–manganese-oxide cathode and a graphite anode, also abbreviated as NMC cell chemistry [25]. These batteries are frequently used in automotive applications, due to their high energy densities [82]. For this cell chemistry a semi-empirical aging model according to [25] is implemented. For the degradation modeling, the charge throughput and time-related parameters are especially important assumptions for the cycle and calendar degradation respectively. Here, the charge throughput and time relationship, introduced in [25] are defined as 𝑄0.55 and 𝑡 0.75. For the ambient temperature, a German temperature profile is considered [83]. The battery end-of-life is defined at 80% remaining capacity, as nonlinear degradation mechanisms may lead to accelerated aging beyond this point and battery safety concerns become more prominent at low SOH levels [81].

3.3. Scenarios and performance indicators

To examine the economic potential of application stacking in V2G, scenarios are constructed to observe the effects of different operation strategies. This primarily concerns different combinations of served applications, starting with only BTM applications, and then gradually adding FCR and SMT. Furthermore, as it has been argued that unidirectional smart charging could cover a large percentage of potential V2G value [13], simulations with and without bidirectional charging are performed and results assessed. Additionally, we analyze the merit of enabling or disabling FTM to BTM energy exchange as a further parameter. Finally, the effect of degradation awareness on revenue and lifetime is analyzed. The resulting scenarios are listed in Table 1, with the simple charging reference case S0 forming the benchmark. The scenarios are characterized as follows:

- Reference scenario S0 uses a simple unidirectional plug and charge approach that charges the battery with maximum power whenever possible, maximizing the SOC level of the EV battery when connected to the grid. We chose this reference scenario due to its simplicity, however, alternative reference scenarios with more favorable effects on battery lifetime exist.

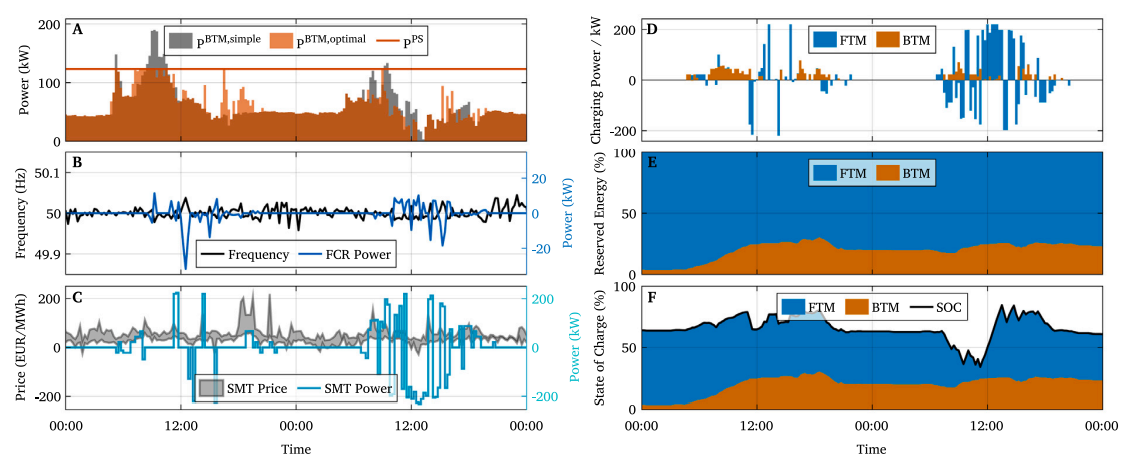

- Scenarios S1 – S8 follow an optimized charging strategy that is provided by the MPC framework. Here the objective function (cf. Eq. (12)) is applied to calculate the optimal operation strategy for the EV fleet, as shown in Fig. 4.

- To analyze the added value from bidirectional charging scenarios S2 – S8 are applied with the V2G technology, allowing power flows from the vehicle to the grid. • The energy shift from the FTM to the BTM partition is allowed and analyzed in scenarios S4, S6, and S8.

- To study the effects with different EV fleet sizes the number of participating EVs varies from 1–150, resulting in energy and power capacities of up to 12 MWh and 3.3 MW.

For the techno-economic analysis, four key performance indicators are discussed: the annual and discounted cash flow per EV, the equivalent full cycles (EFC), and the average end-of-life (EOL) of the EV battery. Here, the annual cash flow is defined as the cash flow change between a scenario and the reference S0. For the discounted cash flow calculation until the EV battery’s EOL [7], a 6% interest rate is specified [84]. The framework calculates the corresponding cash flows for the individual applications with the profit functions presented in Section 2. To design a comprehensive techno-economic analysis for EVs, the battery life must be considered in addition to cash flow. For this reason, the battery’s energy throughput in EFC and the battery lifetime are also analyzed. The presented methodology was developed in a MATLAB environment and is available upon request from the lead author.

- Results

To compare the scenarios, simulations until the EVs’ EOL are performed in the described commercial setting. The cash flows and lifetimes are averaged over the entire fleet and regarded on a per vehicle basis in the following sections. Although there are dependencies between the evaluations in the scenario matrix, the individual effects an

You can download the Project files here: Download files now. (You must be logged in).

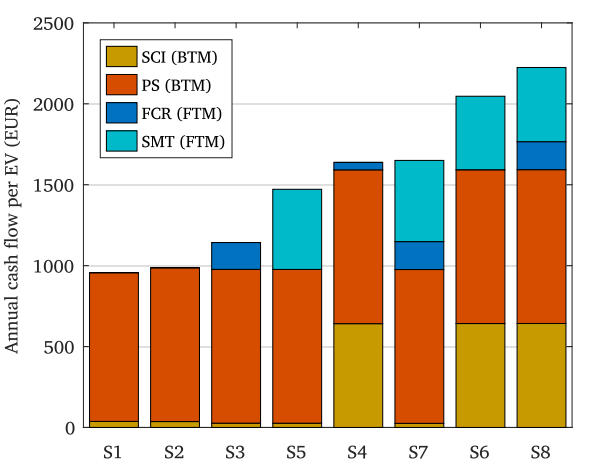

4.1. Economic attractiveness of the value streams

As Fig. 5 shows, there is a clear hierarchy regarding the generated revenue per served application. The application with the highest revenue is PS, followed in this order by SCI and SMT, with FCR making up the least interesting application, economically. In cases with deactivated energy shift from FTM to BTM however, SMT and FCR achieve more revenue than SCI. This pronounced attractiveness of PS is explained by a few factors. Firstly, the regarded case of a commercial player is especially conducive to the PS application, with a combination of an intrinsically high building energy demand and a high potential of power peaks due to the need to charge a fleet of electric vehicles at the same location. Secondly, the PS profit describes the cost savings through the optimized operation over the reference scenario S0, in which the EVs’ SOC is maximized, leading to high power peaks. With demand pull policies in place, increasing consumption from self-generated electricity becomes economically attractive, which leads to the high revenue generated through SCI in this model. SCI profit is also calculated in reference to the same base case as PS, which further

Table 1. Overview of the analyzed EV multi-use scenarios with the applications SCI, PS, FCR, and SMT. During V2G operation, bidirectional charging is enabled. Column FTM2BTM determines if an energy shift from the FTM to BTM partition is allowed. The cash flow defines the annual cash flow increase per vehicle in comparison to the reference scenario S0. The equivalent full cycles (EFC) define the annual energy throughput. The numbers shown refer to a fleet of 10 EVs.

| Scenario | Applications | Optimized charging | V2G | FTM2BTM | Cash flow (EUR/a) | EFC/a | EOL (a) |

|---|---|---|---|---|---|---|---|

| S0 | – | no | no | no | 0 | 47.4 | 7.9 |

| S1 | SCI, PS | yes | no | no | 956 | 47.4 | 11.8 |

| S2 | SCI, PS | yes | yes | no | 987 | 47.5 | 11.6 |

| S3 | SCI, PS, FCR | yes | yes | no | 1143 | 54.7 | 9.8 |

| S4 | SCI, PS, FCR | yes | yes | yes | 1638 | 47.8 | 11.6 |

| S5 | SCI, PS, SMT | yes | yes | no | 1472 | 72.3 | 8.7 |

| S6 | SCI, PS, SMT | yes | yes | yes | 2047 | 61.1 | 10.3 |

| S7 | SCI, PS, FCR, SMT | yes | yes | no | 1650 | 71.6 | 8.7 |

| S8 | SCI, PS, FCR, SMT | yes | yes | yes | 2224 | 60.7 | 10.3 |

explains the cash flow increase. This is however only the case when energy shifting from the FTM to BTM partition is permitted, with SCI only contributing marginally to the annual revenues in the remaining scenarios. This is due to the added flexibility through energy trading, which is more closely examined in Section 4.3. FCR in most cases contribute less to the overall revenue of V2G, as relatively low FCR remuneration prices currently limit profitability. SMT generally being more profitable than FCR is explained by the more volatile price structure as well as the lower requirements compared to providing.

4.2. Added value from EV multi-use and V2G

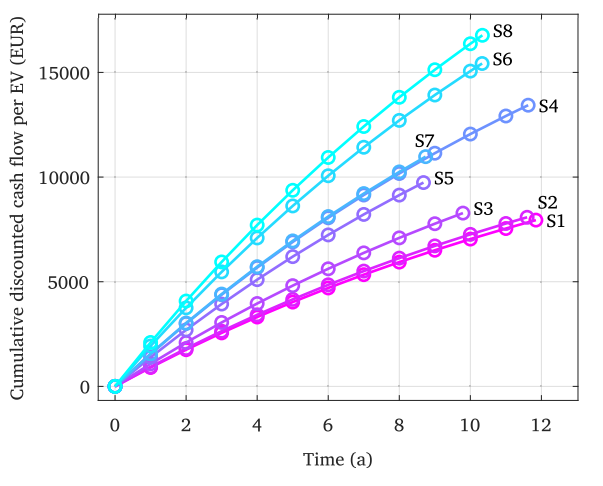

A general trend that is shown in Table 1 and Fig. 6, is an increase in positive cash flow as more applications are served by the same fleet, with the highest revenues being achieved by bidirectional V2G with all four applications and activated energy shift (scenario S8). This however coincides with limited battery lifetimes, due to the increased energy throughput, and thus higher EFCs. This confirms previous findings with stationary battery storage systems [7]. Contrary to stationary storage systems, unidirectional EVs can only charge when connected to the charger. When comparing the scenarios S1 (unidirectional charging) and S2 (bidirectional) we show that the annual cash flow increases by 3% when analyzing a fleet with 10 EVs (cf. Table 1). Comparing both scenarios with the reference scenario, it becomes clear that optimized unidirectional charging yields a similar benefit as the bidirectional case, which matches the observation made in [13] that unidirectional smart charging already covers a large portion of V2G potential when grid applications are excluded. When considering FTM applications, such as FCR, V2G capability is a prerequisite for market participation. There are three clusters to the trend of higher revenues with increasing numbers of applications in EV multi-use. Firstly, the scenarios S1 and S2 show the lowest cumulative cash flow in comparison to the other optimized scenarios S3 – S8. Secondly, it is observed that the cases S3, S5 and S7 show an especially defined decrease in battery lifetime. Thirdly, scenarios S4, S6 and S8 form the cluster with the highest economic increase (cf. Fig. 6). These effects are explained with changes introduced by activating or deactivating energy shift from the FTM to BTM partition.

4.3. Shifting energy from FTM to BTM partition

To examine the effect of permitting an energy shift from the FTM to BTM partition for the purpose of driving, the relevant scenario pairs for comparison are S3/S4, S5/S6 and S7/S8. In all cases, allowing this energy shift leads to a significant improvement in both generated revenue and battery lifetime. As illustrated in Fig. 5, these revenue increases are largely due to a rise in SCI revenue, which is primarily driven by the combination with the SMT application. This reveals a

central advantage of application stacking with permitted energy shift, namely that FTM applications are used to supply energy necessary for mobility provision (cf. Eq. (19)) and guarantee more flexibility for the batteries SOC, without violating preference SOC constraints. In times when FTM electricity costs plus the added charges to shift FTM electricity to BTM partition are cheaper than BTM electricity, charging costs are reduced, which benefits the SCI application. The advantage of multi-use thus arises mainly through added flexibility and the interaction between applications. Based on these results, policy makers that aim to accelerate the electric mobility transition should consider permitting FTM to BTM energy exchange to serve vehicles’ mobility needs, for vehicles providing grid services. Particularly noteworthy here is the SMT application, as this service provides a substantial flexibility increase for the other BTM and FTM applications. Through direct trades during the SMT application, or scheduled transactions during FCR, the application purchases FTM electricity, which is later shifted into the BTM application for mobility purposes. This again reduces the amount of electricity that must be purchased on the BTM side, which increases the profitability of the SCI application significantly. This opportunistic behavior leads to cases where S4 yields similar cash flows to scenario S7, although the latter serves all applications. It is observed that cases with permitted FTM to BTM shifting, namely S4, S6 and S8, experience especially pronounced degradation benefits. This emphasizes the advantages from increased flexibility due to shifting opportunities, which prevents the preemptive behavior of high power charging of the batteries to meet preference SOC requirements in the future. Conclusively, the increased operational flexibility

Table 2. Overview of the analyzed EV multi-use scenarios without an active degradation awareness. The cash flow defines the annual cash flow increase in comparison to the reference scenario S0. The equivalent full cycles (EFC) define the annual energy throughput. The numbers shown refer to a fleet of 10 EVs.

| Scenario | Cash flow (EUR/a) | EFC/a | EOL (a) |

|---|---|---|---|

| S0 | 0 | 47.4 | 7.9 |

| S1 | 956 | 47.4 | 11.8 |

| S2 | 987 | 47.5 | 11.6 |

| S3 | 1108 | 149.7 | 9.2 |

| S4 | 1634 | 130.1 | 10.4 |

| S5 | 2687 | 331.6 | 4.3 |

| S6 | 3203 | 313.3 | 4.3 |

| S7 | 2819 | 330.5 | 4.3 |

| S8 | 3348 | 312.6 | 4.4 |

is not only attractive from a revenue perspective, but also mitigates battery degradation, due to the usage of a broader SOC band and comparatively lower voltage levels [25].

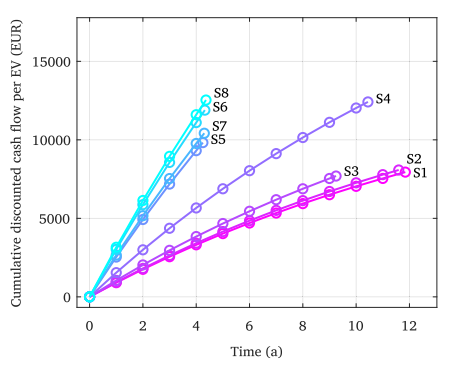

4.4. Neglecting the costs of battery aging

To illustrate the effect of including costs from aging in the optimization, the presented simulations are repeated without degradation awareness. The results of those simulations are shown in Table 2 and Fig. 7. As visible in the results, the scenarios S1 and S2 do not change significantly. This is explained by the fact that the necessary energy throughput of each EV is primarily driven by the mobility service. As more applications are added, however, the revenues of these scenarios increase more steeply, but the overall battery lifetime is significantly reduced. This is especially evident with S8, which now reaches 80% of the initial battery capacity after 4.4 years instead of 10.3 years (cf. Tables 1 and 2) but manages to achieve a discounted cash flow of almost 13 000 EUR during the 4.4 year battery lifetime. The simple charging reference case S0 reaches its end-of-life after 7.9 years. When introducing optimized charging schemes, overall revenue and in some scenarios even the lifetime is increased. However, neglecting opportunity costs per cycle leads to an even further decrease in lifetime for bidirectional V2G, due to the increased energy throughput. If the optimization is made degradation aware, lifetime is significantly extended for most scenarios or at least maintained. This strengthens previous findings, which emphasized the importance of intelligent charging schemes to extend battery lifetimes [85].

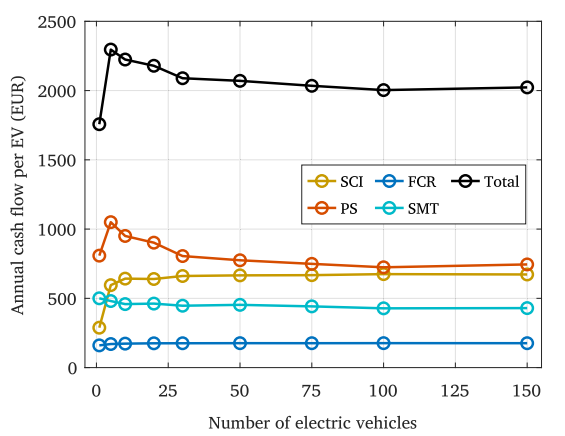

4.5. Sensitivity analysis on the EV fleet size

A further interesting aspect of EV multi-use is its behavior with changing fleet sizes. To examine this, the scenarios are analyzed with increasing numbers of vehicles up to 150 EVs, the results of which are shown in Fig. 8. The annual cash flow initially increases when more vehicles are added, before decreasing again and gradually flattening with rising EV numbers. This behavior is observed with all examined scenarios. To interpret the reasons for this behavior, Fig. 8 also includes the changes in annual cash flow per served application. While FCR revenues only rise slightly initially and remain mostly constant, SMT shows a declining and later saturating trend, while PS has an initial peak, before showing the same pattern. SCI revenues initially show a large cash flow increase with rising fleet size, before also going into saturation. These observations are primarily driven by the fleets’ power and energy demand, as well as the homogeneity of the vehicle usage pattern with growing fleet sizes. When analyzing a fleet with a single vehicle, the optimization has little room for flexibility and is highly dependent on the respective driving profile, which limits the possible cash flow increase. This effect is especially visible with PS, where the timing for charging and existing power peaks are more important. For this reason, adding more vehicles initially leads to an increase in total revenue per EV. As the numbers increase the residual load of the commercial player becomes increasingly defined by the charging power of the vehicle fleet, with fewer opportunities to shift additional power peaks. This leads to the receding annual cash flow from PS in Fig. 8, which settles around an annual cash flow of 740 EUR. As SCI revenues are also defined by the increase compared to the reference charging profile, they initially benefit from the increased flexibility with a growing fleet size. As the fleet size rises, the building’s PV generation can be utilized, which contributes to growing SCI revenues, before saturating as the self-generated electricity is consumed for charging the EVs. As more energy can be used to charge the vehicles, less energy from the FTM partition is shifted to the BTM partition, which allows more energy to be purchased and later sold on the spot market, further explaining the slightly higher SMT revenues initially. As the cost for energy shifted from FTM to BTM is subtracted from the SCI application revenue, this also further explains SCI initially benefiting strongly from rising fleet sizes. The FCR cash flows marginally grow at the beginning, which is due to an increase in fleet diversity, which makes power commitments over the necessary FCR provision times more achievable.

You can download the Project files here: Download files now. (You must be logged in).

5. Conclusions

As electric vehicle market penetration steadily rises it becomes increasingly important to conceptualize intelligent charging schemes to mitigate excessive grid infrastructure stress. Using smart bidirectional charging schemes not only minimizes these negative effects from electric vehicle charging but also provides a diverse set of benefits and economic opportunities. In this context, we analyze grid services for electric vehicles with an emphasis on application stacking to form an electric vehicle multi-use concept. For this purpose, a model predictive control framework with an embedded mixed integer linear programming algorithm is developed to evaluate different combinations of vehicle-to-grid based self-consumption increase, peak shaving, spot market trading and frequency containment reserve in the context of a commercial player with an office building and an electric vehicle fleet. This optimization framework is coupled with a semi-empirical battery aging model, to calculate effects on the electric vehicle battery lifetimes. In contrast to previous contributions, this paper focuses on serving multiple applications simultaneously, as well as the separation of storage capacity and power in behind-the-meter and in front-of- the-meter partitions. Furthermore, differences between unidirectional and bidirectional charging as well as effects from front-of-the-meter to behind-the-meter energy shifting, fleet size and aspects regarding degradation modeling are examined.

Based on nine scenarios the results of these simulations show both technical and economic benefits when serving multiple applications simultaneously with electric vehicle fleets. Depending on the served applications, the activation of bidirectional charging and activation of an energy shift between front-of-the-meter and behind-the-meter partitions, an annual cash flow increase between 956 EUR to 2224 EUR per vehicle compared to the simple charging reference case is achieved. The most attractive result is achieved by serving all four applications with the permitted energy shift, which leads to a cumulative discounted cash flow per vehicle of about 17 000 EUR over a lifetime of over 10 years. A clear trend is demonstrated, in which revenue increases as more applications are served and more flexibility through bidirectional charging and front-of-the-meter to behind-the-meter energy shifting is enabled. It is shown that the applications peak shaving and self-consumption increase generate the most revenue, while other applications contribute to achieving more operational flexibility and thus improving overall performance. It is observed that unidirectional smart charging almost reaches the same annual cash flow as bidirec- tional charging when performing peak shaving and self-consumption increase. Allowing energy to be shifted from the front-of-the-meter to the behind-the-meter partition yields a significant increase in cash flow and battery lifetime, due to the increased flexibility. The optimization is applied with opportunity costs for battery degradation, which are implemented in the objective function. It is thus demonstrated that optimized charging including degradation costs leads to an extension of battery lifetime, while operation strategies without degradation awareness can lead to lifetime reduction of up to 6 years. Finally, it is demonstrated that growing fleet sizes initially coincide with increasing cash flows per vehicle, as more flexibility is enabled. With a fleet size above five vehicles a further increase leads to receding cash flows per vehicle, as more capacity must be allocated to mitigate power costs from the increasing charging peaks. This effect weakens for larger vehicle fleets and the annual cash flow per vehicle saturates at about 100 participating electric vehicles.

For our approach, uncertainties and limitations are considered. Firstly, prediction quality is assumed to be perfect within the rolling horizon and constant annual market prices are assumed over the regarded lifetime. Depending on respective developments in regulation and price structure, especially the latter could change the results both positively and negatively. This paper also operates from the perspective of a fleet operator maximizing revenues and does not consider effects on the grid, such as mitigated power peaks, which could lead to a reduction in societal costs for infrastructure. Furthermore, certain regulatory boundaries are neglected, such as minimum bidding increments, which will require sufficient energy and power capacities. We assume that simultaneous service of front-of-the-meter and behind-the-meter applications is possible, with front-of-the-meter electricity being exempt from taxes and surcharges. In the chosen commercial electric vehicle fleet use case, all vehicles return to one location after route completion; the added complexity of multiple charging locations is an area that can be explored in further research. While this paper makes statements regarding discounted cash flow, a rating of investment attractiveness is not performed. To do this, a calculation of the net present value is necessary, which requires an accurate determination of the financial value of mobility provision, as well as the investment costs.

Further topics for future research could also include additional applications, such as grid congestion management or providing re- active power, as these have been predicted to also be interesting for vehicle-to-grid concepts. Such approaches should emphasize the spatial–temporal flexibility of electric vehicles, as this has implications for infrastructure impact of grid-integrated electric vehicles. Future re- search can explore additional sensitivity analyses, such as degradation behavior with different fleet sizes and battery end-of-life definitions. Likewise, the presented model can be adjusted to apply to regulatory conditions in additional countries, as the comparison of the effects of different regulatory positions is of interest to policy makers and industry players. Finally, while simulation results make a promising case for electric vehicle multi-use, these results remain to be confirmed by field tests.

References

- JacobsonMZ, Delucchi MA, Bauer ZA, Goodman SC, Chapman WE, Cameron MA, Bozonnat C, Chobadi L, Clonts HA, Enevoldsen P, Erwin JR, Fobi SN, Gold-strom OK, Hennessy EM, Liu J, Lo J, Meyer CB, Morris SB, Moy KR, O’Neill PL, Petkov I, Redfern S, Schucker R, Sontag MA, Wang J, Weiner E, Yachanin AS. 100% clean and renewable wind, water, and sunlight all-sector energy roadmaps for 139 countries of the world. Joule 2017;1(1):108–21. http://dx.doi.org/10. 1016/j.joule.2017.07.005.

- Gallo AB, Simões-Moreira JR, Costa H, Santos MM, Moutinho dos Santos E.Energy storage in the energy transition context: A technology review. Renew Sustain Energy Rev 2016;65:800 22. http://dx.doi.org/10.1016/j.rser.2016.07. 028.

- Lott MC, Kim S-I, Tam C, Houssin D, Gagne J-F. Technology roadmap – energy International Energy Agency; 2014, URL https://www.iea.org/reports/ technology-roadmap-energy-storage.

- Ziegler MS, Trancik JE. Re-examining rates of lithium-ion battery technologyimprovement and cost decline. Energy Environ Sci 2021. http://dx.doi.org/10. 1039/D0EE02681F.

- Tsiropoulos I, Tarvydas D, Lebedeva N. Li-Ion Batteries for Mobility and Station-ary Storage Applications Scenarios for Costs and Market Growth. Luxembourg: Publications Office of the European Union; 2018, http://dx.doi.org/10.2760/ 87175.

- FiggenerJ, Stenzel P, Kairies K-P, Linß en J, Haberschusz D, Wessels O, Robinius M, Stolten D, Sauer DU. The development of stationary battery storage systems in Germany–status 2020. J Energy Storage 2021;33:101982. http://dx. org/10.1016/j.est.2020.101982.

- EnglbergerS, Jossen A, Hesse Unlocking the potential of battery storage with the dynamic stacking of multiple applications. Cell Rep Phys Sci 2020;1(11). http://dx.doi.org/10.1016/j.xcrp.2020.100238.

- Fitzgerald G, Mandel J, Morris J, Touati H. The Economics of Battery EnergyStorage: How multi-use, customer-sited batteries deliver the most services and value to customers and the Rocky Mountain Institute; 2015, URL https://rmi.org/insight/economics-battery-energy-storage/.

- Stephan A, Battke B, Beuse M, Clausdeinken JH, Schmidt T. Limiting the publiccost of stationary battery deployment by combining applications. Nat Energy 2016;1:16079. http://dx.doi.org/10.1038/nenergy.2016.79.

- InternationalEnergy Agency (IEA). Global EV outlook 2021, URL https://www.iea.org/reports/global-ev-outlook-2021.

- Kempton W, Tomić J. Vehicle-to-grid power fundamentals: Calculating capacityand net revenue. J Power Sources 2005;144:268–79. http://dx.doi.org/10.1016/ jpowsour.2004.12.025.

- White CD, Zhang Using vehicle-to-grid technology for frequency regulation and peak-load reduction. J Power Sources 2011;196(8):3972–80. http://dx.doi. org/10.1016/j.jpowsour.2010.11.010.

- Element Energy Limited and Energy Systems Catapult and Cenex and Nis- san Technical Centre Europe and Moixa and Western Power Distribution and National Grid V2GB – vehicle to grid britain: Project report. 2019, URL http://www.element-energy.co.uk/wordpress/wp-content/uploads/ 2019/06/V2GB-Public-Report.pdf.

- Thingvad A, Martinenas S, Andersen PB, Marinelli M, Olesen OJ, Christensen Economic comparison of electric vehicles performing unidirectional and bidirec- tional frequency control in denmark with practical validation. In: 2016 51st international universities power engineering conference. IEEE; 2016, p. 1 6. http://dx.doi.org/10.1109/UPEC.2016.8113988.

- Banol Arias N, Hashemi S, Andersen PB, Traeholt C, Romero R. Distributionsystem services provided by electric vehicles: Recent status, challenges, and future IEEE Trans Intell Transp Syst 2019;20(12):4277 96. http://dx. doi.org/10.1109/TITS.2018.2889439.

- HesseH, Schimpe M, Kucevic D, Jossen Lithium-ion battery storage for the grid—A review of stationary battery storage system design tailored for applications in modern power grids. Energies 2017;10(12). http://dx.doi.org/ 10.3390/en10122107.

- SchmidtO, Melchior S, Hawkes A, Staffell Projecting the future levelized cost of electricity storage technologies. Joule 2019;3(1):81–100. http://dx.doi.org/10. 1016/j.joule.2018.12.008.

- Müller M, Viernstein L, Truong CN, Eiting A, Hesse H, Witzmann R, Jossen A.Evaluation of grid-level adaptability for stationary battery energy storage system applications in europe. J Energy Storage 2017;9:1–11. http://dx.doi.org/10. 1016/j.est.2016.11.005.

- Battke B, Schmidt T. Cost-efficient demand-pull policies for multi-purposetechnologies – the case of stationary electricity storage. Appl Energy 2015;155:334–48. http://dx.doi.org/10.1016/j.apenergy.2015.06.010.

- SchmidtO, Hawkes A, Gambhir A, Staffell The future cost of electrical energy storage based on experience rates. Nat Energy 2017;2:1–8. http://dx.doi.org/10. 1038/nenergy.2017.110.

- ZameKK, Brehm CA, Nitica AT, Richard CL, Schweitzer III Smart grid and energy storage: Policy recommendations. Renew Sustain Energy Rev 2018;82:1646–54. http://dx.doi.org/10.1016/j.rser.2017.07.011.

- BraeuerF, Rominger J, McKenna R, Fichtner Battery storage systems: An economic model-based analysis of parallel revenue streams and general implications for industry. Appl Energy 2019;239:1424–40. http://dx.doi.org/10. 1016/j.apenergy.2019.01.050.

- Schimpe M, Naumann M, Truong CN, Hesse H, Santhanagopalan S, Saxon A,Jossen A. Energy efficiency evaluation of a stationary lithium-ion battery container storage system via electro-thermal modeling and detailed component Appl Energy 2018;210:211–29. http://dx.doi.org/10.1016/j.apenergy. 2017.10.129.

- Lombardi P, Schwabe F. Sharing economy as a new business model for energystorage systems. Appl Energy 2017;188:485–96. http://dx.doi.org/10.1016/j. 2016.12.016.

- SchmalstiegJ, Käbitz S, Ecker M, Sauer A holistic aging model for Li(NiMnCo)O2 based 18650 lithium-ion batteries. J Power Sources 2014;257:325–34. http://dx.doi.org/10.1016/j.jpowsour.2014.02.012. Keil P, Schuster SF, Wilhelm J, Travi J, Hauser A, Karl R, Jossen A. Calendar aging of lithium-ion batteries: I. Impact of the graphite anode on capacity fade. J Electrochem Soc 2016;163(9):1872–80. http://dx.doi.org/10.1149/2.0411609jes.

- Englberger S, Hesse H, Hanselmann N, Jossen A. SimSES multi-use: A simulationtool for multiple storage system applications. In: 2019 16th International conference on the european energy market; 2019. p. 1–5. https://doi.org/10. 1109/EEM.2019.8916568.

- Davies DM, Verde MG, Mnyshenko O, Chen YR, Rajeev R, Meng YS, Elliott G.Combined economic and technological evaluation of battery energy storage for grid applications. Nat Energy 2019;4(1):42–50. http://dx.doi.org/10.1038/ s41560-018-0290-1.

- Eyer J, Corey G. Energy storage for the electricity grid: Benefits and marketpotential assessment guide. Sandia National Laboratories 2010;20(10):5, URL https://downloads.regulations.gov/EPA-HQ-OAR-2010-0799-0030/content.pdf.

- Sovacool BK, Kester J, Noel L, Zarazua de Rubens G. Actors, business models,and innovation activity systems for vehicle-to-grid (V2G) technology: A compre- hensive review. Renew Sustain Energy Rev 2020;131:109963. http://dx.doi.org/ 1016/j.rser.2020.109963.

- StaudtP, Schmidt M, Gärttner J, Weinhardt A decentralized approach towards resolving transmission grid congestion in Germany using vehicle-to- grid technology. Appl Energy 2018;230:1435–46. http://dx.doi.org/10.1016/j. apenergy.2018.09.045.

- Knezovic K, Martinenas S, Andersen PB, Zecchino A, Marinelli M. Enhancing therole of electric vehicles in the power grid: Field validation of multiple ancillary IEEE Trans Transp Electr 2017;3(1):201–9. http://dx.doi.org/10.1109/ TTE.2016.2616864.

- Sortomme E, El-Sharkawi MA. Optimal charging strategies for unidirectionalvehicle-to-grid. IEEE Trans Smart Grid 2011;2(1):131–8. http://dx.doi.org/10. 1109/TSG.2010.2090910.

- Tan KM, Ramachandaramurthy VK, Yong JY. Integration of electric vehicles insmart grid: A review on vehicle to grid technologies and optimization techniques. Renew Sustain Energy Rev 2016;53:720–32. http://dx.doi.org/10.1016/j.rser. 09.012.

- Englberger S, Hesse H, Kucevic D, Jossen A. A techno-economic analysis ofvehicle-to-building: Battery degradation and efficiency analysis in the context of coordinated electric vehicle charging. Energies 2019;12(5). http://dx.doi.org/ 3390/en12050955.

- FerreiraRJ, Miranda LM, Araujo RE, Lopes A new bi-directional charger for vehicle-to-grid integration. In: 2011 2nd IEEE PES international conference and exhibition on innovative smart grid technologies. IEEE; 2011, p. 1–5. http://dx.doi.org/10.1109/ISGTEurope.2011.6162770.

- Dogger JD, Roossien B, Nieuwenhout FDJ. Characterization of Li-Ion batteries forintelligent management of distributed grid-connected storage. IEEE Trans Energy Convers 2011;26(1):256–63. http://dx.doi.org/10.1109/TEC.2009.2032579.

- Hernández JC, Sanchez-SutilF, Vidal PG, Rus-Casas Primary frequency control and dynamic grid support for vehicle-to-grid in transmission systems. Int J Electr Power Energy Syst 2018;100:152–66. http://dx.doi.org/10.1016/j.ijepes. 2018.02.019.

- QuinnC, Zimmerle D, Bradley The effect of communication architecture on the availability, reliability, and economics of plug-in hybrid electric vehicle-to- grid ancillary services. J Power Sources 2010;195(5):1500–9. http://dx.doi.org/ 10.1016/j.jpowsour.2009.08.075.

- Knezović K, Marinelli M, Zecchino A, Andersen PB, Traeholt C. Supportinginvolvement of electric vehicles in distribution grids: Lowering the barriers for a proactive integration. Energy 2017;134:458–68. http://dx.doi.org/10.1016/j. 2017.06.075.

- Hill DM, Agarwal AS, Ayello F. Fleet operator risks for using fleets for V2G Energy Policy 2012;41:221–31. http://dx.doi.org/10.1016/j.enpol. 2011.10.040.

- Noel L, Zarazua de Rubens G, Sovacool BK. Optimizing innovation, carbon andhealth in transport: Assessing socially optimal electric mobility and vehicle-to- grid pathways in Denmark. Energy 2018;153:628–37. http://dx.doi.org/10.1016/ energy.2018.04.076.

- GschwendtnerC, Sinsel SR, Stephan Vehicle-to X (V2X) implementation: An overview of predominate trial configurations and technical, social and regulatory challenges. Renew Sustain Energy Rev 2021;145:110977. http://dx.doi.org/10. 1016/j.rser.2021.110977.

- Das HS, Rahman MM, Li S, Tan CW. Electric vehicles standards, charging infras-tructure, and impact on grid integration: A technological review. Renew Sustain Energy Rev 2020;120:109618. http://dx.doi.org/10.1016/j.rser.2019.109618.

- Parra D, Patel MK. The nature of combining energy storage applications forresidential battery technology. Appl Energy 2019;239:1343–55. http://dx.doi. org/10.1016/j.apenergy.2019.01.218.

- BanolArias N, Hashemi S, Andersen PB, Traeholt C, Romero Assessment of economic benefits for EV owners participating in the primary frequency regulation markets. Int J Electr Power Energy Syst 2020;120:105985. http://dx.doi.org/10.1016/j.ijepes.2020.105985.

- Andersen PB, Toghroljerdi SH, Sørensen TM, Christensen BE, Høj JCML,Zecchino A. The parker project: Final report. 2019, URL https://parker-project. com/wp-content/uploads/2019/03/Parker_Final-report_v1.1_2019.pdf.

- Turton H, Moura F. Vehicle-to-grid systems for sustainable development: Anintegrated energy Technol Forecast Soc Change 2008;75(8):1091–108. http://dx.doi.org/10.1016/j.techfore.2007.11.013.

- Odkhuu N, Lee K-B, A. Ahmed M, Kim Y-C. Optimal energy management ofV2B with RES and ESS for peak load minimization. Appl Sci 2018;8(11):2125. http://dx.doi.org/10.3390/app8112125.

- Geske J, Schumann D. Willing to participate in vehicle-to-grid (V2G)? Whynot!. Energy Policy 2018;120:392–401. http://dx.doi.org/10.1016/j.enpol.2018. 004.

- HauptH, Bäuml G, Bärwaldt G, Nannen H, Kammerlocher The INEES research project – intelligent grid integration of electric vehicles to provide system services. In: Liebl J, editor. Grid integration of electric mobility. Wiesbaden: Springer Nature; 2017, p. 105–15. http://dx.doi.org/10.1007/978-3-658-15443-1.

- Database EV Database – v4.2. 2020, URL https://ev-database.org/.

- Comello S, Reichelstein S. The emergence of cost effective battery storage. NatCommun 2019;10(1):1–9. http://dx.doi.org/10.1038/s41467-019-09988-z.

- Luthander R, Widén J, Nilsson D, Palm J. Photovoltaic self-consumption inbuildings: A review. Appl Energy 2015;142:80–94. http://dx.doi.org/10.1016/ apenergy.2014.12.028.

- MoshövelJ, Kairies K-P, Magnor D, Leuthold M, Bost M, Gährs S, Szczechowicz E, Cramer M, Sauer DU. Analysis of the maximal possible grid relief from PV-peak- power impacts by using storage systems for increased self-consumption. Appl Energy 2015;137:567–75. http://dx.doi.org/10.1016/j.apenergy.2014.07.021.

- MunkhammarJ, Grahn P, Widén Quantifying self-consumption of on-site pho- tovoltaic power generation in households with electric vehicle home charging. Sol Energy 2013;97:208–16. http://dx.doi.org/10.1016/j.solener.2013.08.015.

- Oudalov A, Cherkaoui R, Beguin A. Sizing and optimal operation of batteryenergy storage system for peak shaving application: 2007 IEEE lausanne power In: IEEE PowerTech, 2007 IEEE Lausanne; 2007. p. 1–5, https://doi.org/ 10.1109/PCT.2007.4538388.

- Shi Y, Xu B, Wang D, Zhang B. Using battery storage for peak shaving andfrequency regulation: Joint optimization for superlinear gains. IEEE Trans Power Syst 2018;33(3):2882–94. http://dx.doi.org/10.1109/TPWRS.2017.2749512.

- Kucevic D, Englberger S, Sharma A, Trivedi A, Tepe B, Schachler B, Hesse H,Srinivasan D, Jossen A. Reducing grid peak load through the coordinated control of battery energy storage systems located at electric vehicle charging parks. Appl Energy 2021;116936. http://dx.doi.org/10.1016/j.apenergy.2021.116936.

- Tiemann PH, Bensmann A, Stuke V, Hanke-Rauschenbach R. Electrical energystorage for industrial grid fee reduction – A large scale analysis. Energy Con- version Manag 2020;208:112539. http://dx.doi.org/10.1016/j.enconman.2020. 112539.

- Wang Z, Wang S. Grid power peak shaving and valley filling using vehicle-to-grid IEEE Trans Power Deliv 2013;28(3):1822–9. http://dx.doi.org/10.1109/ TPWRD.2013.2264497.

- Thien T, Schweer D, vom Stein D, Moser A, Sauer DU. Real-world operatingstrategy and sensitivity analysis of frequency containment reserve provision with battery energy storage systems in the german market. J Energy Storage 2017;13:143–63. http://dx.doi.org/10.1016/j.est.2017.06.012.

- 50Hertz Transmission GmbH, Amprion GmbH, TenneT TSO GmbH, TransnetBW Präqualifikationsverfahren für Regelreserveanbieter. 50Hertz Transmis- sion GmbH, Amprion GmbH, TenneT TSO GmbH, TransnetBW GmbH; 2019, URL https://www.regelleistung.net/ext/static/prequalification.

- European Commission. Guideline on electricity balancing. Official Journal of theEuropean Union: European Commission; 2017, URL https://eur-lex.europa.eu/ legal-content/EN/TXT/?uri=CELEX%3A32017R2195.

- Greenwood DM, Lim KY, Patsios C, Lyons PF, Lim YS, Taylor PC. Frequencyresponse services designed for energy storage. Appl Energy 2017;203:115–27. http://dx.doi.org/10.1016/j.apenergy.2017.06.046.

- BrandtT, Wagner S, Neumann Evaluating a business model for vehicle- grid integration: Evidence from Germany. Transp Res Part D: Transp Environ 2017;50:488–504. http://dx.doi.org/10.1016/j.trd.2016.11.017. Metz D, Saraiva JaT. Use of battery storage systems for price arbitrage opera- tions in the 15- and 60-min German intraday markets. Electr Power Syst Res 2018;160:27–36. http://dx.doi.org/10.1016/j.epsr.2018.01.020.

- Wesselmann M, Wilkening L, Kern TA. Techno-Economic evaluation of singleand multi-purpose grid-scale battery systems. J Energy Storage 2020;32:101790. http://dx.doi.org/10.1016/j.est.2020.101790.

- Hanemann P, Bruckner T. Effects of electric vehicles on the spot market price.Energy 2018;162:255–66. http://dx.doi.org/10.1016/j.energy.2018.07.180.

- Brown MA, Zhou S, Ahmadi M. Smart grid governance: An international reviewof evolving policy issues and innovations. Wiley Interdiscip Rev: Energy Environ 2018;7(5):e290. http://dx.doi.org/10.1002/wene.290.

- EnglbergerS, Chapman A, Tushar W, Almomani T, Snow S, Witzmann R, Jossen A, Hesse H. Evaluating the interdependency between peer-to-peer net- works and energy storages: A techno-economic proof for prosumers. Adv Appl Energy http://dx.doi.org/10.1016/j.adapen.2021.100059.

- Al-Obaidi A, Khani H, Farag HE, Mohamed M. Bidirectional smart charging ofelectric vehicles considering user preferences, peer to peer energy trade, and pro- vision of grid ancillary services. Int J Electr Power Energy Syst 2021;124:106353. http://dx.doi.org/10.1016/j.ijepes.2020.106353.

- BDEW Bundesverband der Energie- und Wasserwirtschaft eV. Strompreis- 2020, URL https://www.bdew.de/service/daten-und-grafiken/bdew- strompreisanalyse/.

- Fraunhofer Institute for Solar Energy Systems ISE. Spot market prices. 2020, URLhttps://energy-charts.info/charts/price_spot_market/chart.htm?l=en&c=DE.

- Kucevic D, Tepe B, Englberger S, Parlikar A, Mühlbauer M, Bohlen O, Jossen A,Hesse H. Standard battery energy storage system profiles: Analysis of various applications for stationary energy storage systems using a holistic simulation J Energy Storage 2020;28:101077. http://dx.doi.org/10.1016/j.est. 2019.101077.

- Gaete-Morales C, Zerrahn A, Schill W-P. Emobpy. 2019, URL https://gitlab.com/diw-evu/emobpy/emobpy.

- FederalMinistry of Transport and Digital Infrastructure; URL https://www.kba.de/DE/Statistik/Kraftverkehr/VerkehrKilometer/vk_ inlaenderfahrleistung/vk_inlaenderfahrleistung_inhalt.html?nn=2351536.

- 50Hertz Transmission GmbH, Amprion GmbH, TenneT TSO GmbH, TransnetBW Datacenter FCR/aFRR/mfrr. 2020, URL https://www.regelleistung.net/ apps/datacenter/tenders/.

- Lehmbruck L, Kretz J, Aengenvoort J, Sioshansi F. Aggregation of front- andbehind-the-meter: the evolving VPP business model. In: Sioshansi F, editor. Behind and beyond the meter. Academic Press; 2020, p. 211–32. http://dx.doi. org/10.1016/B978-0-12-819951-0.00010-4.

- Sears J, Roberts D, Glitman K. A comparison of electric vehicle Level 1 and Level2 charging efficiency. In: 2014 IEEE conference on technologies for sustainability; p. 255–8. https://doi.org/10.1109/SusTech.2014.7046253.

- Severson KA, Attia PM, Jin N, Perkins N, Jiang B, Yang Z, Chen MH, Aykol M,Herring PK, Fraggedakis D, Bazant MZ, Harris SJ, Chueh WC, Braatz RD. Data- driven prediction of battery cycle life before capacity degradation. Nat Energy 2019;4(5):383–91. http://dx.doi.org/10.1038/s41560-019-0356-8.

- DingY, Cano ZP, Yu A, Lu J, Chen Automotive li-ion batteries: Current status and future perspectives. Electrochem Energy Rev 2019;2(1):1–28. http://dx.doi.org/10.1007/s41918-018-0022-z.

- Wetterdienst Air temperature Germany, Munich 2018. 2018, URL https://opendata.dwd.de/climate_environment/CDC/observations_germany/ climate/hourly/air_temperature/historical/.

- HafezO, Bhattacharya Optimal design of electric vehicle charging stations considering various energy resources. Renew Energy 2017;107:576–89. http://dx.doi.org/10.1016/j.renene.2017.01.066.

- UddinK, Dubarry M, Glick The viability of vehicle-to-grid operations from a battery technology and policy perspective. Energy Policy 2018;113:342–7. http://dx.doi.org/10.1016/j.enpol.2017.11.015.

You can download the Project files here: Download files now. (You must be logged in).

Keywords: Battery Peak shaving, Frequency regulation, Spot-market trading, Vehicle-to-grid, Multi-use Electric vehicle

Responses